BROWSE OUR BLOG TO LEARN MORE ABOUT RETIREMENT PLANNING, TAXES, AND MORE!

The Fed Holds Rates, Here’s What That Means for Your Retirement

For the fourth time in a row, the Federal Reserve has decided to hold interest rates steady, keeping the federal funds rate at 4.25%–4.50%. On the surface, that might sound uneventful—but beneath the calm, there’s plenty going on. And if you're retired or nearing retirement, the ripple effects of this decision are worth paying attention to. So, what’s driving the [...]

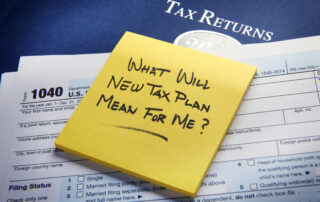

How Could the One Big Beautiful Bill Impact Taxes for Retirees?

The One Big Beautiful Bill (OBBB) includes several tax changes that directly affect retirees, especially how their Social Security is taxed, how much of their income is shielded by deductions, and how much they can deduct in-state and local taxes (SALT). While some speculate that tax deductions could cause further deficit and Social Security Trust fund issues in the future, [...]

What Retirees Need to Know About the New “One Big Beautiful Bill”

President Trump’s newly passed “One Big Beautiful Bill” (OBBB) is making headlines, and retirees might want to pay close attention. Aimed at expanding the 2017 Tax Cuts and Jobs Act (TCJA), this sweeping legislation includes a mix of tax breaks and potential pitfalls that could impact seniors for years to come. Potential Benefits of the “One Big Beautiful Bill” Proposal [...]

Claiming Social Security at the Right Time Could Change Your Retirement

For many retirees, Social Security isn’t just a monthly deposit—it’s the foundation of their entire retirement income. But choosing when to claim it isn’t as simple as picking a birthday and signing paperwork. It’s a decision with lifelong consequences. Claim too early, and you could lock in thousands less per year. Wait too long without a plan, and you might [...]

Why It’s Crucial to Boost Savings Before Retirement

For those nearing retirement, there’s one truth that becomes increasingly clear: the window to build wealth narrows with each passing year. While starting early is always ideal, it’s not too late for pre-retirees in their 50s or early 60s to make meaningful progress toward financial security. In fact, now is the time to double down on savings—and fortunately, there are [...]

How Pre-Retirees Can Jumpstart Their Savings in 2025

Catching up on retirement savings can feel daunting, especially if you've started late. However, with strategic planning and commitment, it's entirely possible to build a comfortable nest egg for your future. Here are five actionable steps to help you enhance your retirement savings in 2025. Leverage Catch-Up Contributions For individuals aged 50 and above, the IRS allows additional "catch-up" contributions [...]

Policy Changes: What Retirees Need to Know

Retirement planning can sometimes feel like trying to hit a moving target. Policies change, rules shift, and retirees often find themselves needing to adapt their strategies to keep pace. Many recent policy changes affecting retirement have many people asking, "What does this mean for my financial future?" Let’s break it down in simple terms, talk about the potential risks, and [...]

Slower Rate Cuts, The Market, and Your Finances

Whether you’re checking your account balances, planning your next adventure, or enjoying a well-earned retirement, markets move... and with it, your account values may as well. Recent market volatility, driven by the Federal Reserve’s announcement to slow rate cuts, has left many retirees wondering what this means for their financial future. Let’s explore the situation and how you can confidently [...]